single life annuity vs lump sum

The end result shows that the present. Federal law requires companies to offer a life annuity as an option.

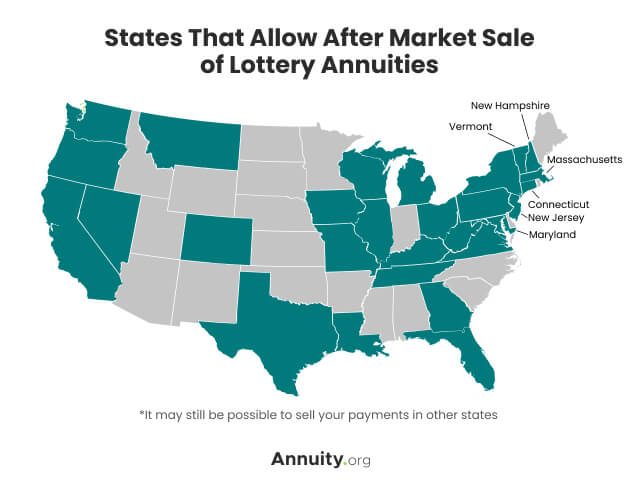

Lottery Payout Options Annuity Vs Lump Sum

It will offer guaranteed income for the rest of.

. Ad Thrivent Annuities can help you plan for income in retirement for as long as you live. A large cash payment now. A lump sum could be passed on to heirs if a balance.

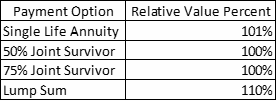

Instead of putting all of your trust in a pension fund manager you decide where to put your money. If youre a single female and your monthly annuity is valued at 351000 and the lump sum pension offer is 400000 then you can see the lump sum is worth about 14 more. You can choose to receive your pension as a single lump sum or as regular annuity payments over time.

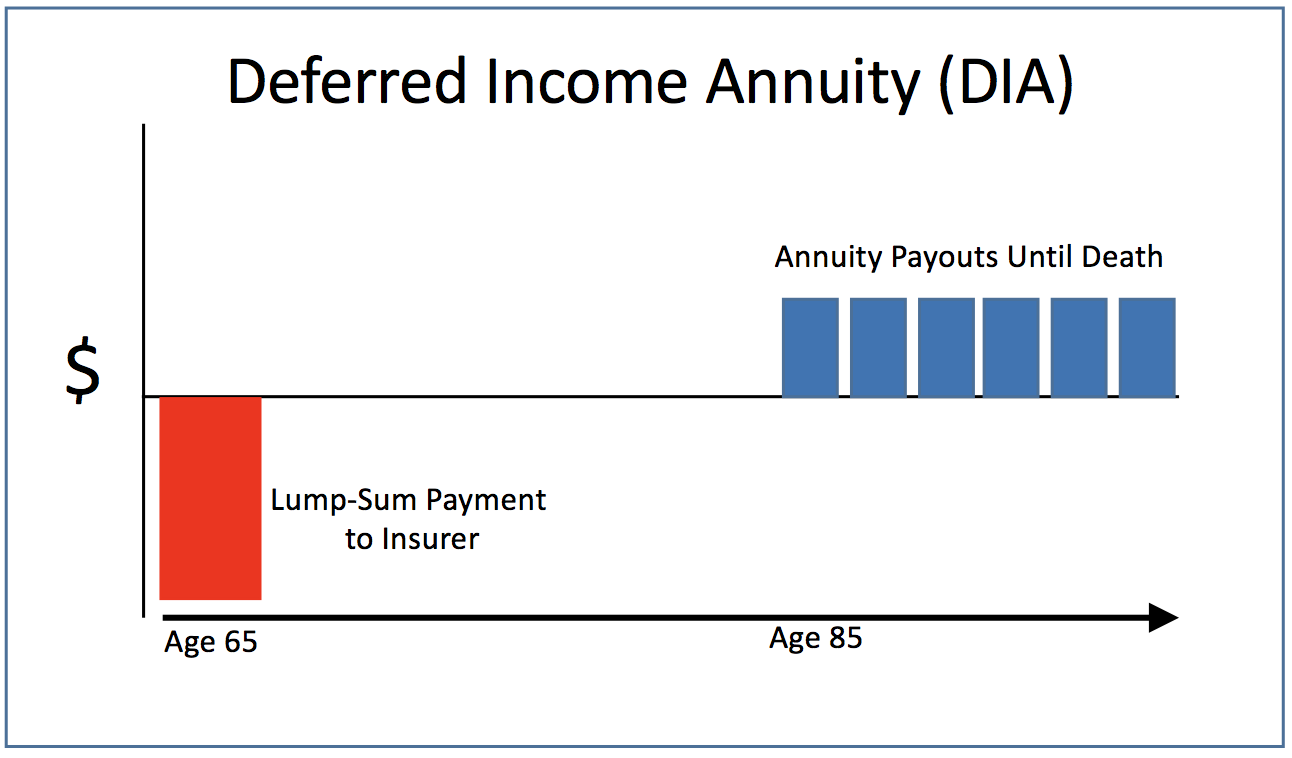

Of them all the single life annuity offers the. Its a single large sum of money that you receive all at once. An immediate annuity will pay benefits within a year of your premium payment.

Even if the income generated from the lump sum is less than the promised annuity. Ad Learn More about How Annuities Work from Fidelity. If you take the 2500 per month then when you do.

Gift and estate planning. With a lump sum there is always the risk that you will run out of money if you live a long life. Unless you choose a term certain or survivor benefit option your annuity ceases when you die.

Ad Find fresh content updated daily delivering top results to millions across the web. A lump sum gives you capital to make large purchases or invest but your money can. Your employer has also offered to pay you a lump sum of 300000 if you want to give up your monthly pension payments.

Generally the option with a higher present value is the better deal. In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on average. Another benefit of the annuity is that it can help you keep up with inflation.

The main benefit though is the flexibility to invest the. With a lump sum. Learn some startling facts.

Single life annuity. In a multi-employer plan payouts are limited to 3575 per month times years of. Ad Get this must-read guide if you are considering investing in annuities.

A large cash payment now. After the date of your first payment you cannot. PBGC pays lump sums only when a total benefit has a value of 5000 or less.

A lump sum is a one-time payment. Life Annuity for a Pension Payout. Find powerful content for lump sum vs annuity.

An annuity is a series of payments made at regular intervals over a certain. Annuity companies look at the average life expectancy of your age group and primarily base the pension income on that with interest rates playing a secondary role. If youre planning for retirement annuities may compliment your current strategy.

Ad Learn More about How Annuities Work from Fidelity. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Based on the simple back of the envelope calculation you might conclude.

The potential disadvantages of an annuity are exactly what can make a lump-sum payment appealing. The main benefit of a lump-sum payment is the flexibility that it provides. Ad Annuities are often complex retirement investment products.

By accepting a lump sum from the pension you gain the control over your income assets. In a single-employer plan the maximum annual benefit the PBGC pays to a 65-year-old is 67295. The potential disadvantages of an annuity are exactly what can make a lump-sum payment appealing.

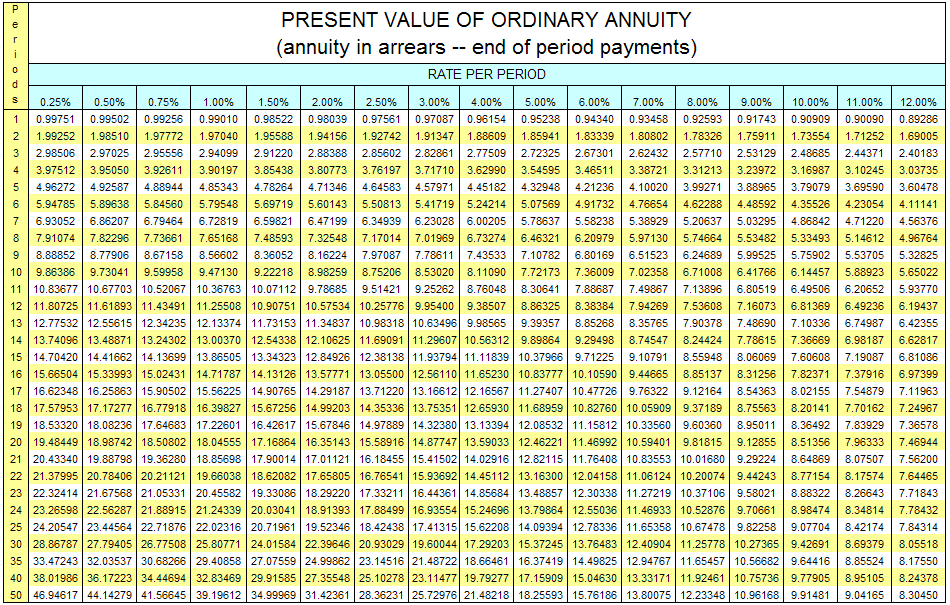

A simplified illustration. Individuals with employer-sponsored defined contribution plans or. The savings interest rate that you designate is used to calculate present value for the annuity payment option and is.

The main benefit though is the flexibility to invest the. You can purchase this annuity through a single lump-sum payment. Lets start with the lump sum Option A against the originally promised lifetime annuity Option C.

Get this must-read guide if you are considering investing in annuities. All other benefits are paid as a monthly annuity.

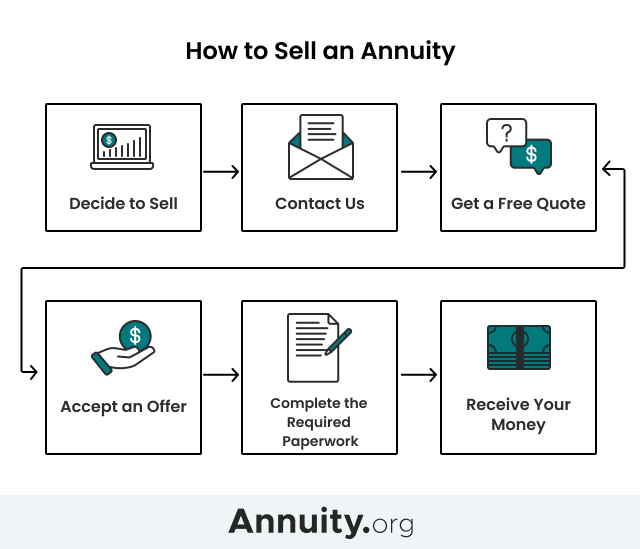

How To Sell Your Annuity Payments For Cash Step By Step Guide

Annuity Beneficiaries Inherited Annuities Death

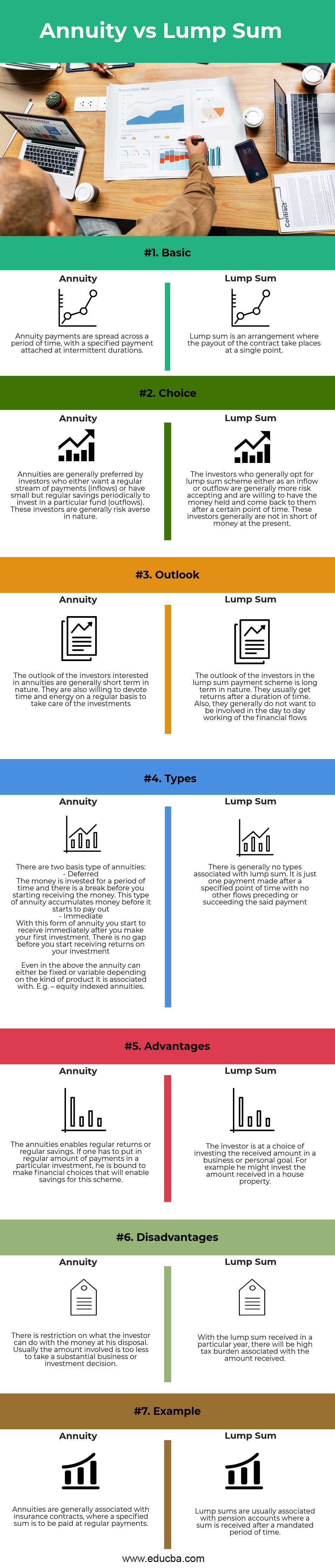

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Strategies To Maximize Pension Vs Lump Sum Decisions

Lottery Winner S Dilemma Lump Sum Or Annuity

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

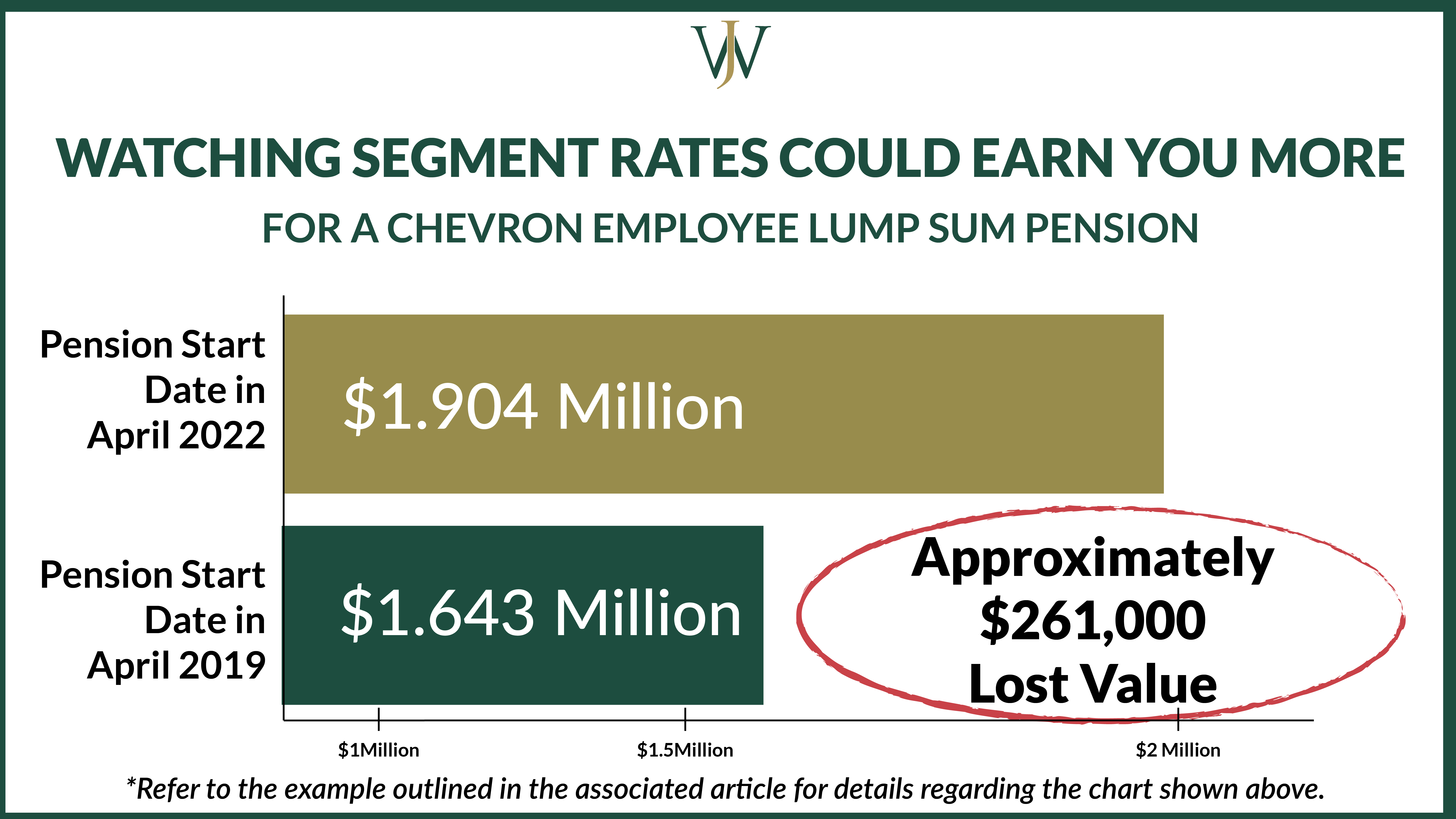

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Difference Between Annuity And Lump Sum Payment Infographics

Difference Between Annuity And Lump Sum Payment Infographics

Pension Lump Sum Payout Vs Monthly Annuity Keil Financial Partners

How Much Income Do Annuities Pay

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Annuity Payout Options Immediate Vs Deferred Annuities

Lottery Payout Options Annuity Vs Lump Sum

When Can You Cash Out An Annuity Getting Money From An Annuity